Ask the dealership if there’s a funding Office committed to dealing with those with weak credit rating.

Provides that look on This page are from third-social gathering advertisers from which Credit rating Karma normally receives payment.

Individual loans could be an selection for People that has a 420 credit score. These loans are typically unsecured, which means they do not require collateral, that may be an important point For lots of applicants.

"Figuring out and disputing problems in your credit history report can perhaps increase your rating considerably."

Alternatively, they might offer you rewards and benefits that seem sensible in the event you presently shop at the store in issue.

The TASI® Bank software system generally takes about just one week for approval. The procedure will involve distributing an application, verifying records, meeting in-person, aquiring a TASI® Financial institution member pay a visit to your business, and conducting an inner compliance audit.

Knowing the implications of this type of rating is important for anyone seeking to navigate the advanced more info environment of borrowing. This portion will provide an overview of financial literacy ahead of delving into functional tricks for taking care of loan selections accessible to People which has a very low credit rating score.

At WalletHub, we make an effort to list as many charge card delivers as you possibly can and presently have more than 1,500 offers, but we don't list all out there presents or economic company providers.

For borrowers which has a 420 credit score, a secured loan can sometimes be a perfect selection to consider, especially if they possess useful assets.

It could nonetheless be truly worth closing the account if the line of credit history is costing you an yearly fee or for those who’re concerned about stepping into debt, but know about the potential impact on your credit rating.

Assessing Loan Features: A pre-approval means that you can Appraise a variety of loan offers using a clearer point of view on your own economical standing.

Loan Denials: Many lenders will reject applications from folks with these kinds of reduced scores. This can limit access to critical money sources necessary for emergencies or significant buys.

Be mindful of opportunity alterations inside the credit rating sector; keep informed about new lending products and solutions or regulatory alterations that might influence your status.

They hold the probable to impact selections and bring about extra favorable outcomes. Understanding the options available is important, as this understanding empowers borrowers to choose proactive measures to bettering their loan prospective customers.

Ariana Richards Then & Now!

Ariana Richards Then & Now! Kelly McGillis Then & Now!

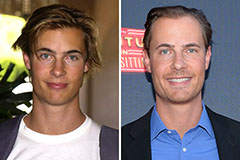

Kelly McGillis Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!